Press Releases

Cartwright Seeks Answers from Treasury on CARES Act Stimulus Payment Prepaid Cards, Future Distributions

Scranton, PA,

June 5, 2020

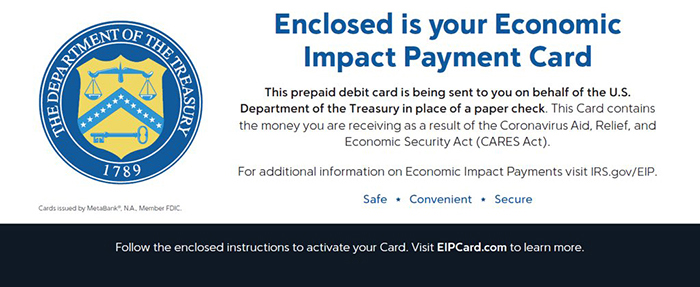

U.S. Representative Matt Cartwright (PA-08) today raised concern with the U.S. Treasury Department’s use of prepaid cards to distribute Coronavirus Aid, Relief and Economic Security (CARES) Act stimulus payments to certain eligible workers and families through a third-party financial institution. In recent days, numerous constituents have contacted Cartwright with questions regarding the cards’ authenticity, and frustrations over the activation process, withdrawal limits, and ‘out-of-network’ ATM fees, among other concerns. Cartwright plans to inquire about how the Treasury Department came to the decision to issue prepaid cards, and to urge the Department to be more transparent about how future payments will be disbursed. “I can’t blame people for being suspicious of this card or for being frustrated with all the complications,” Cartwright said. “Maybe this was a well-intentioned effort. But I question whether a prepaid card from outside the Treasury that comes with so much fine print actually accomplishes that goal. The Treasury Department has some explaining to do about how this decision was made, why certain fees are necessary, and how they’re getting future payments out. More than two months after the passage of the CARES Act, so many are still waiting for this critical relief. This process needs to be as simple and efficient as possible.” ABOUT THE EIP PREPAID CARDS The Coronavirus Aid, Relief and Economic Security (CARES) Act enacted in March provides for immediate, direct cash payments to lower-and middle-income Americans of $1,200 for each adult and $500 for each child, beginning to phase out at an annual income of $75,000 for an individual and $150,000 for a household. So far, $239 billion worth of payments has been distributed via direct deposit, paper check or Direct Express card accounts, according to the latest Treasury Department report. On May 18, the U.S. Treasury Department announced that MetaBank – Treasury’s “financial agent” – was sending four million prepaid cards to a highly specific group of Americans: taxpayers who do not have bank account information on file with the IRS from the 2018 or 2019 tax years and have had their returns processed by the IRS Service Centers in Andover, Massachusetts or Austin, Texas. It comes in the following envelope:

A photo of the card:

How to use it Instructions are enclosed in the mailing envelope and also viewable online at https://www.eipcard.com/. The card can be activated online or via the customer service phone line at 1-800-240-8100. Where the card can be used According to the EIP card website, the card can be used anywhere a Visa card is an acceptable form of payment. Cash can be withdrawn at an ATM, but MetaBank charges a fee for using an “out of network” ATM. MetaBank directs cardholders to use the surcharge-free ATM locator online at https://www.eipcard.com/locator. The funds can be transferred to a bank account by activating the EIP card online or via phone, or using the Money Network Mobile App. Fees

More information on the fee schedule can be found at https://www.eipcard.com/fee-schedule. Withdrawal Limit There is a $1,000 per day ATM withdrawal limit, although some banks and accounts may have lower limits. How to request a new card if lost Replacement cards can be requested via the MetaBank customer service phone line at 1-800-240-8100 (option 2 from main menu). Individuals do not need to know their card number to request a replacement. |